A debt collection letter is a critical tool in the creditor’s arsenal, serving as a formal communication to individuals or businesses with outstanding debts. The effectiveness of such a letter lies not just in its ability to prompt payment, but also in maintaining a professional relationship with the debtor.

Crafting a debt collection letter requires a delicate balance of firmness and diplomacy. In this blog post, we will delve into the essential tips and strategies needed to write an effective debt collection letter, ensuring that your communication is clear, professional, and most importantly, successful in achieving its goal.

1. Know Your Audience

Understanding the debtor, and your audience is crucial in the debt collection process. Before drafting your letter, consider the debtor’s financial situation, history, and communication preferences. This insight can guide you in personalizing the letter, making it more likely to be received positively.

A letter that acknowledges the debtor’s circumstances and offers understanding may foster cooperation, leading to a more amicable resolution. It’s about striking the right chord – your letter should resonate with the debtor, encouraging them to clear their dues, while also showing empathy towards their financial situation.

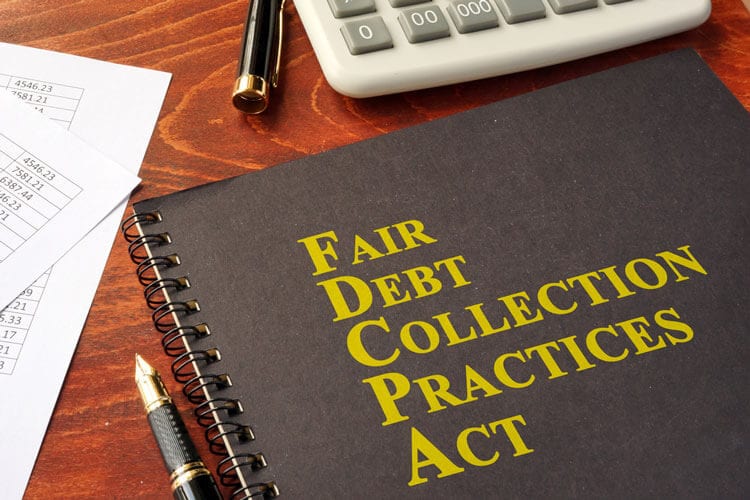

2. Legal Compliance

Legal compliance is non-negotiable in debt collection which is something you can find out more here. It’s imperative to familiarize yourself with laws governing debt collection, such as the Fair Debt Collection Practices Act (FDCPA) in the United States. These laws outline what you can and cannot do when collecting debts.

Your letter must adhere to these legal standards to avoid potential legal issues. This means avoiding any language that could be construed as harassing, threatening, or misleading. Ensure that your letter is straightforward, respectful, and in full compliance with the relevant laws and regulations. This not only protects you legally but also upholds a standard of professionalism in your communications.

3. Use Clear and Concise Language

Clarity and simplicity are paramount when writing a debt collection letter. The goal is to communicate the necessary information without overwhelming or confusing the debtor. Avoid jargon and complex language that might make the letter difficult to understand.

Use straightforward language to explain the situation. The debtor should be able to understand the content of the letter easily – what the debt is for, how much is owed, and how they can make the payment. Clear communication reduces misunderstandings and increases the likelihood of the debtor taking the necessary action.

4. State the Purpose Clearly

The primary purpose of your letter – debt collection – should be clear from the beginning. Right from the first paragraph, state that the letter is an attempt to collect a debt and any information obtained will be used for that purpose.

This not only meets legal requirements but also sets the tone for the rest of the letter. Be direct yet respectful, ensuring that the debtor understands the seriousness of the situation while feeling respected and valued.

5. Provide Details

Your debt collection letter should include specific information about the debt. Mention the amount owed, the name of the creditor, and the due date for the payment. If there are any additional charges or interest, these should also be detailed. Providing a breakdown of the debt helps the debtor understand exactly what they are being asked to pay, eliminating any confusion and increasing the chances of payment.

6. Offer Payment Options

Offering payment options can greatly facilitate debt recovery. Many debtors may be willing to pay but are unable due to their financial situation. By offering flexible payment options or setting up payment plans, you make it easier for them to comply.

This not only shows empathy towards the debtor’s situation but also increases the likelihood of recovering the full amount. Make sure to outline these options clearly in the letter, providing all necessary details for each option.

7. Be Respectful and Professional

Maintaining a respectful and professional tone throughout your letter is essential. This fosters a positive relationship with the debtor and reflects well on your business. Avoid aggressive or threatening language. Instead, use polite and courteous language, reinforcing your willingness to find a mutually beneficial solution. A respectful approach can often lead to more successful debt recovery compared to confrontational methods.

8. Set Deadlines

Setting clear deadlines is important to prompt action from the debtor. State a specific date by which you expect a response or payment. This creates a sense of urgency and encourages the debtor to act promptly.

Be reasonable in setting these deadlines, giving the debtor enough time to arrange for the payment. Also, mention the consequences of non-compliance within the given timeframe, which might include additional charges or further collection efforts.

9. Addressing Disputes

Disputes are not uncommon in debt collection. Your letter should outline the process for the debtor to dispute the debt. This includes how they can contact you to discuss the debt or provide evidence if they believe the debt is incorrect. A clear dispute resolution process not only complies with legal requirements but also builds trust with the debtor, showing that you are open to communication and willing to resolve issues fairly.

10. Follow-Up Strategies

If the debtor does not respond to your initial letter, having a follow-up strategy is crucial. Plan when and how you will follow up with additional communications. This might include sending a reminder letter, making a phone call, or using email.

It’s important to remain consistent and persistent, yet respectful and professional in your follow-up efforts. If the debt remains unpaid despite these efforts, you might need to consider escalation options. This could involve enlisting a debt collection agency or pursuing legal action. However, always ensure that any escalation is in line with legal requirements and is conducted professionally.

Conclusion

Writing a debt collection letter is a nuanced task that requires a balance of firmness, empathy, and professionalism.

By understanding your audience, complying with legal standards, using clear and concise language, stating the purpose clearly, providing detailed information, offering payment options, maintaining respect and professionalism, setting clear deadlines, addressing disputes effectively, and having a solid follow-up strategy, you can increase the likelihood of successful debt recovery.

Apply these tips and strategies to ensure that your debt collection letters are effective, professional, and legally compliant.